Tags Artificial Intelligence Customer Experience Data Digital Banking Open Banking Operational Efficiency Payments

The banking sector is becoming both more strategically focused and technologically advanced in order to respond to consumer expectations and try to defend their market shares. As such, the importance of innovation and developing new solutions that take advantage of data, advanced analytics, digital technologies and new delivery platforms has never been more important. In 2019, these efforts are expected to increase, especially in the following ways:

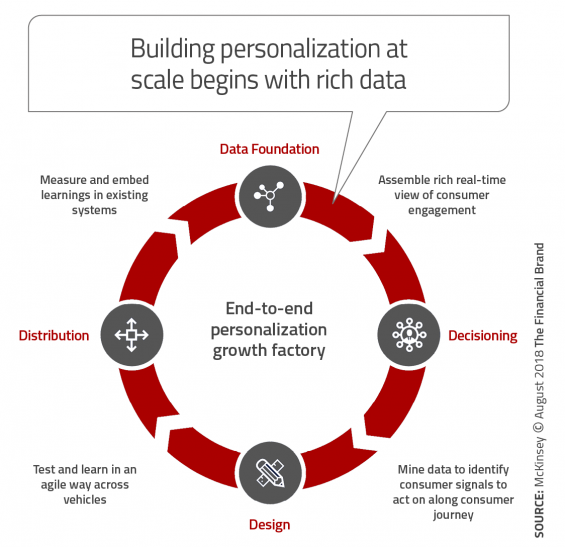

- Serving a segment of one – some banks are now targeting customers based on lifestyles, values, aspirations, mindsets and underserved needs. In 2019, many banking organizations will go beyond personalization by segment and develop the ultimate level of innovative personalization – individualized experiences for a segment of one.

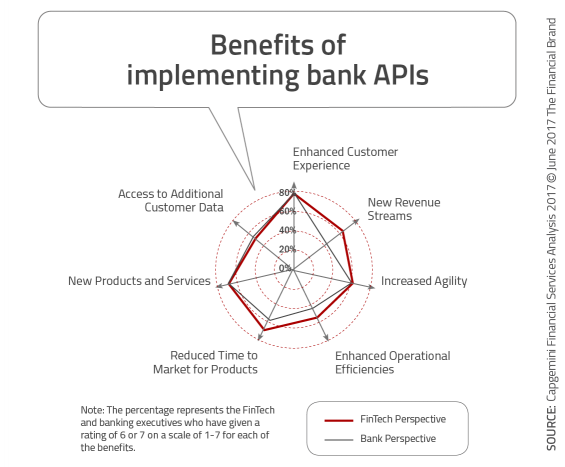

- Expanding open banking – more and more regulatory bodies are requiring banking organizations to enable customers to share their data securely with third parties. Open banking APIs accelerate innovation and collaboration, leading to expanded banking ecosystems that could include more than just financial services to make a consumer’s lifestyle better.

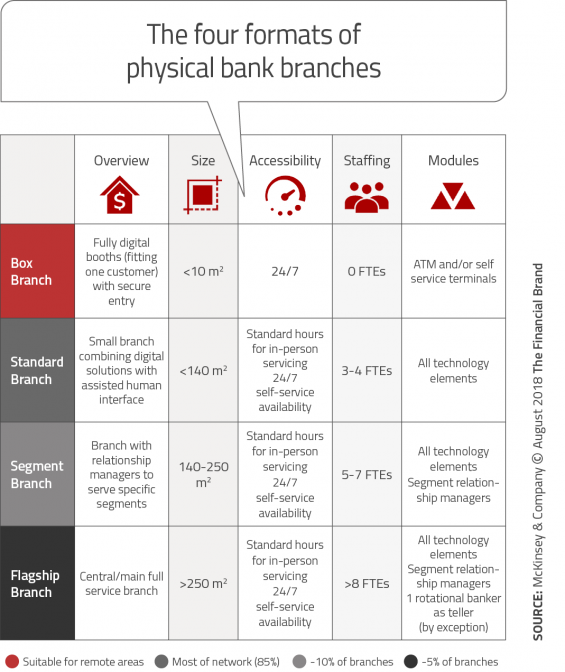

- Committing to phygital delivery – more and more financial services companies are introducing digital banking services as a way to innovate customer experiences and increase value to the consumer. The key challenge is in finding the right mix of physical and digital (i.e. the phygital).

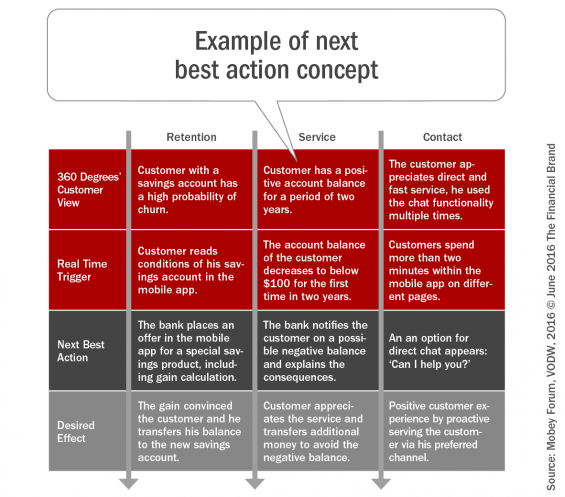

- Implementing AI-driven predictive banking – one of the most exciting innovation trends in 2019 will be the continued movement towards predictive banking. For the first time, the banking industry can consolidate all internal and external data to build predictive profiles of customers and members in real-time. With consumer data that is rich, accessible and financially viable to deploy, financial institutions of all sizes can not only know their customers, they can also provide customized advice for the future.

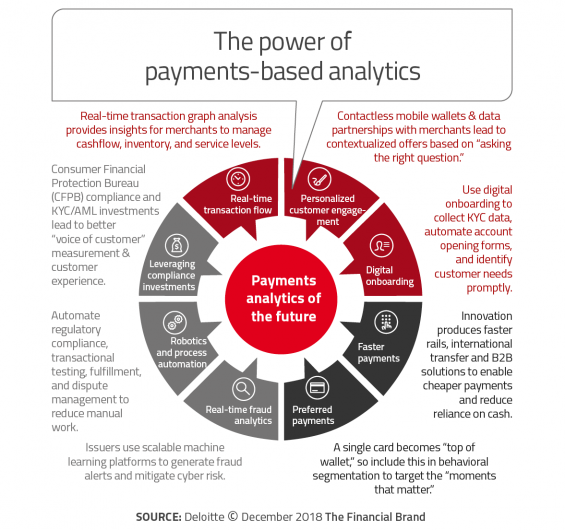

- Rethinking payments – The payments industry has been, and will continue to be, one of the most dynamic areas of innovation in the banking industry. Impacted by changing consumer expectations and driven by technological advances, innovation will continue to come from traditional financial institutions, FinTech firms and big tech players. The impact of this innovation in payments will be a decrease in transaction fees, an increase in the importance of differentiated user experiences and the application of a vast array of data.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest