Tags Customer Experience Startups

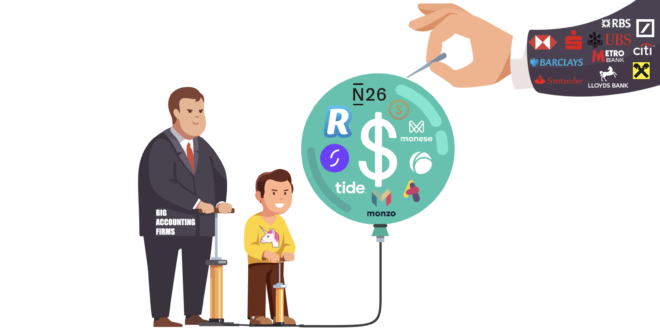

We live in a world of challenger banks, with new ones seemingly rising to new heights overnight. With them has come a hype surrounding the new innovations they offer and the flashy new services they provide consumers. This so-called HypeTech is derided by many as holding back true FinTech advances, which many experts hold is based on artificial intelligence and data science. As evidence of this, these experts point out that many of these challenger banks are not profitable (or even focused on getting into the black). This will inevitably lead consolidation and the establishment of a new normal, one most likely based on more progressive, but ultimately traditional, financial institutions.

This isn’t to say that there are no true FinTech innovators in the market. Transferwise, for example, is using a smart approach to allow people to send and receive money safely from abroad without the high fees, and Funding Circle is doing something similar in SME lending. No doubt some of FinTech innovators will survive, influence the future of the market and, themselves, become a well-established player. But as more and more traditional financial institutions wake up to modern realities and adopt true FinTech solutions, their brands and long-standing reputations will push out most of these newcomers and bring calm to the FinTech storm surge.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest