Tags Customer Experience Digital Banking Identification

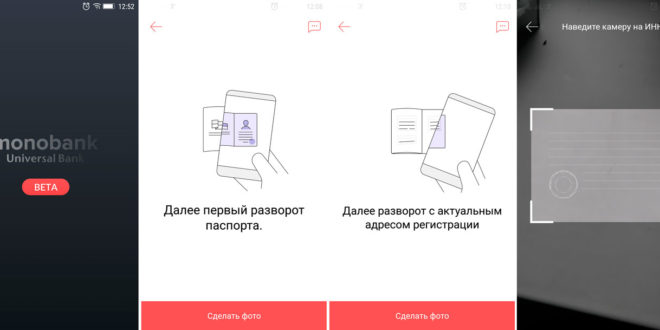

Monobank, the debut project of a Ukrainian FinTech company, is proving to be a strong new competitor in Ukraine’s mobile banking industry. The bank, with its lack of infrastructure, is revolutionizing how the banking sector can look by having its “offices” all located in user smartphones. To get started, users must apply through the app, with a bank courier delivering necessary physical applications, verifying identify documents and delivering the bank card. The mobile bank then allows users to customize how they want their card to work, including setting limits.

In addition to traditional banking services such as loans, the bank also allows user to complete person-to-person (P2P) transfers and make payments for utilities and fines with just a few ticks inside the application. The bank also offers users the chance to earn cashback rewards that instantly appear in user accounts. For users having issues, the bank offers customer service via both a phone line and the most popular instant messenger services.

Monobank is a separate mobile product of Universal Bank, with its own unique branding and product conditions.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest