Tags Digital Banking Digital Transformation

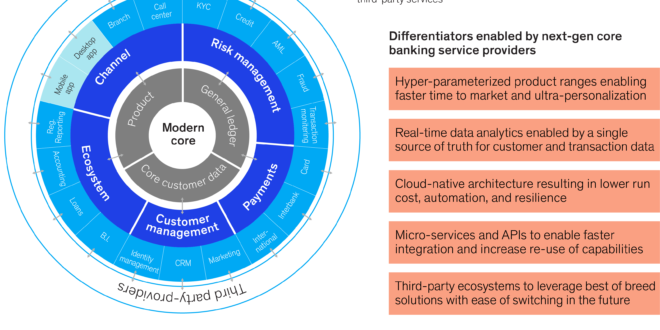

Competition in the banking industry is intensifying, with neo-banks winning more of the market share, FinTechs targeting ever more lucrative niches and BigTech players leveraging their large customer bases. These disruptors are able to grow their businesses (and attract customers) at a much better rate than traditional financial institutions thanks to their use of modern core technology, which enables them to innovate faster and operate more efficiently. Traditional financial institutions, in the meantime, are stuck with the limitations of the legacy systems they use. While some traditional financial institutions have already started moving beyond this, some have remained on the sidelines and are struggling. For these institutions, there are three main choices if they want to survive:

- Full replacement of the core with a new tech stack – this option can be risky as it requires extensive data migration and the benefits are typically only realized when the final customer is migrated and the legacy systems are decommissioned.

- Progressive modernization – this option retains the legacy platform but also progressively minimizes it as modern architecture is built around it. While the approach is lower risk, transition timelines are usually slow, and financial institutions may not achieve desired levels of efficiency and time-to-market.

- Greenfield banking proposition built on a new tech stack – this option enables the quick launch of new offerings and delivers value in a short timeframe. It is often considered less expensive than the other options and safer because the existing customer base is not exposed until the proposition and technology are proven.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest