In 2024, the banking and fintech industry is poised for transformative change, driven by the convergence of immersive, intelligent, and decentralized technologies. Here are the top 15 trends to watch in 2024, according to Vivek Dubey, senior manager at Capgemini:

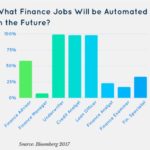

- Intelligent automation – robotic process automation (RPA) and AI will streamline banking operations, enhancing efficiency and allowing human resources to be reallocated to customer service and strategic planning. Key applications include automated account opening, KYC/AML verification, credit scoring, fraud detection and risk assessment.

- AI-powered advisory and asset management – AI will provide personalized financial advice and manage investments, with robo-advisors offering tailored portfolio and automated rebalancing services. This will help democratize access to financial services.

- Generative AI in fintech – AI will customize financial services, with chatbots delivering personalized advice and AI optimizing credit scoring for fairer credit access. Applications include 24/7 customer service chatbots, personalized marketing content and financial guidance.

- Blockchain integration – blockchain and distributed ledger technology (DLT) will revolutionize financial services such as cross-border payments and trade finance. Key uses include streamlining cross-border transactions, improving trade finance processes and developing decentralized finance products.

- Embedded financial solutions – financial services will continue integrating into non-financial platforms, enhancing user experiences through banking-as-a-service solutions, frictionless user journeys and embedded insurance in daily activities.

- Quantum computing – quantum computing will advance financial modeling and risk assessment as well as improve fraud detection. Expect increased research and pilot projects exploring its potential in finance.

- Open banking – expansion of open banking will foster innovations and contribute to increased API adoption. This will eventually cover an even broader range of financial services.

- Cybersecurity – banks and fintechs will bolster cybersecurity with zero-trust architecture, advanced threat detection systems and cyber hygiene education. A big focus will be put on smartphone banking users.

- Sustainability aligning Gen AI and ESG with COP28 – AI and ESG principles will drive sustainable finance, supporting COP28 goals through green finance, ESG investing and AI in renewable energy and sustainable practices.

- The rise of digital currencies and tokenization – digital currencies and tokenization will continue to evolve, impacting finance with cryptocurrencies, stablecoins and asset-backed digital tokens representing real-world assets.

- Cloud-based banking – cloud migration will enable scalable, agile operations as well as the foster adoption of new technologies in banking and fintech.

- Regulatory technology (RegTech) – AI-powered RegTech will automate compliance, enhancing data analysis capacities and risk identification processes.

- Big data and analytics – banks will use big data for hyper-personalization, enhanced risk management, better fraud detection and tailoring services to individual needs.

- Seamless integration of physical and digital worlds – internet of things (IoT) integration will enable connected banking through interactive devices, merging physical and digital banking experiences.

- Metaverse: a convergent digital universe – the metaverse will blend physical and digital realities by hosting business activities, social interactions and immersive experiences in a way that transforms industries.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest