Tags Data Online Lending Payments

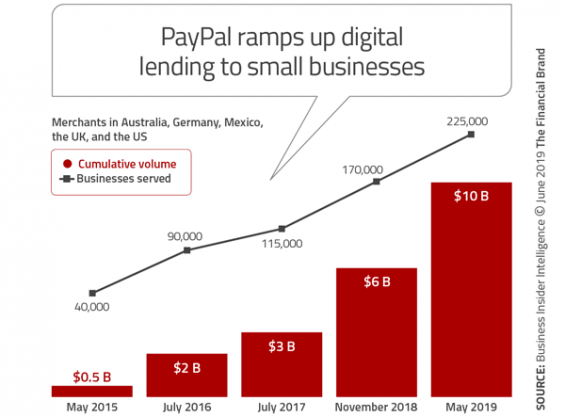

By now, alternative banking service providers (e.g. PayPayl, Venmo, Square) are well-known players in the payment industry. Less known is how many of these companies are expanding into other banking areas. For example, PayPal is rapidly growing as a digital lending alternative, recently announcing that it had crossed the USD 10 billion in small business lending in only 5 years. Similarly, peer-to-peer business lender Funding Circle has experienced a growth of 44% in the number of loans under their management in just 1 year. The relative explosion of these alternative digital lending services is due to 3 key things: (1) they leverage data to provide much-improved consumer experiences; (2) they are able to create new and innovative credit risk models and repayment mechanisms (e.g. automatically taking a predetermined percentage of each sale from online sellers as payment); and (3) access to transactional data lets these alternative digital lenders know when funds might be needed by a small business, often before the small business even knows.

It’s clear that digital lending providers are changing the game. But what does this mean for traditional financial institutions? In short, they will need to build more digital processes from the ground up that are able to quickly analyze requests. They also need to better know their consumers and meet (and exceed) their expectations. Interestingly, there may be other opportunities for these traditional financial institutions. For example, many tech companies are partnering with traditional players since they don’t have licenses to take deposits on their own. At any rate, the industry is changing, and traditional financial institutions will have to change their approaches or risk becoming a casualty of the digital revolution.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest