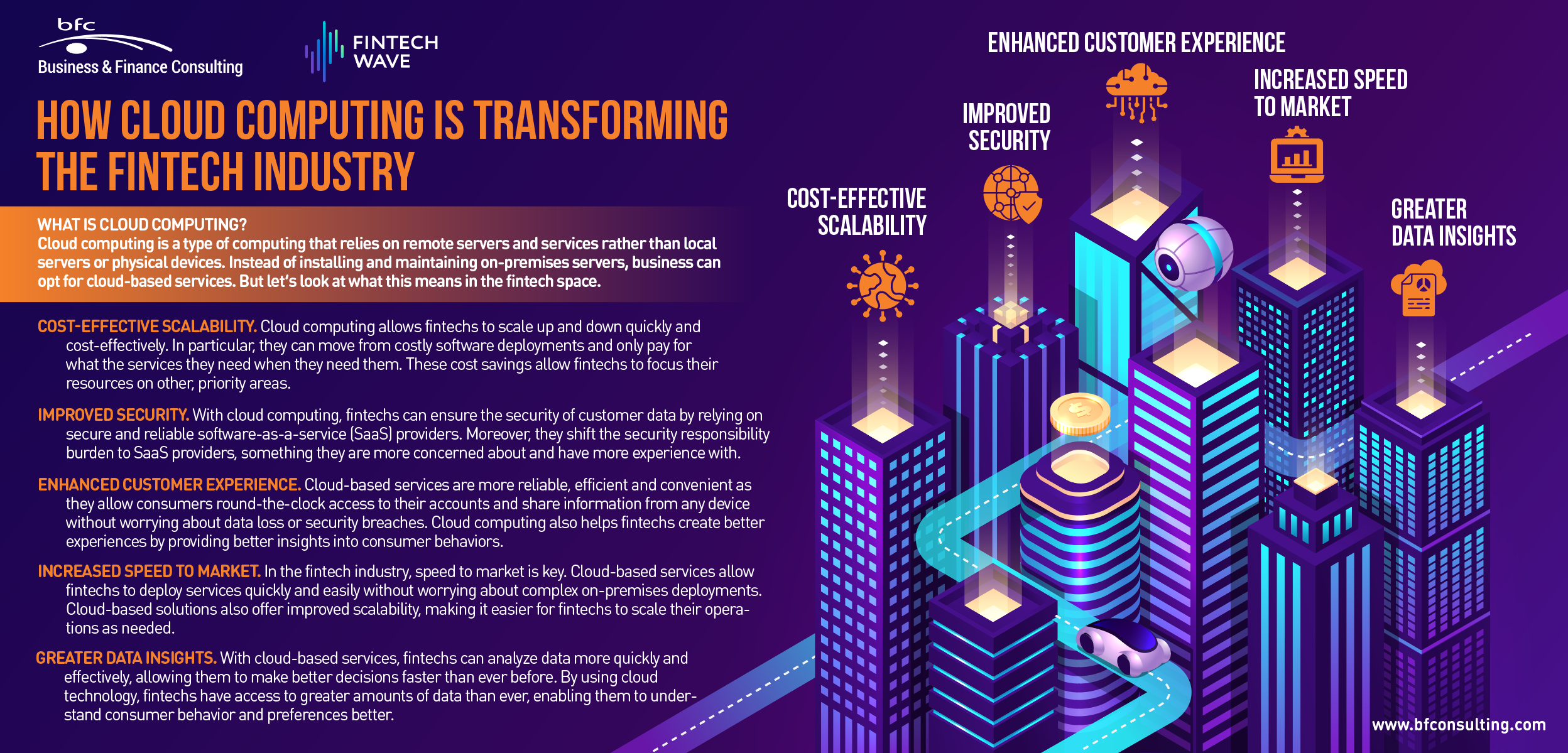

Cloud computing has revolutionized how financial service companies operate, allowing them to access, store and process data more efficiently and securely than ever before. This has opened up a world of products, services and technologies that are transforming the financial landscape. Let’s explore how cloud computing is changing the fintech industry and what this means for businesses and consumers in this insightful infographic.

What is Cloud Computing?

Cloud computing is a type of computing that relies on remote servers and services rather than local servers or physical devices. Instead of installing and maintaining on-premises servers, business can opt for cloud-based services. But let’s look at what this means in the fintech space.

Cost-Effective Scalability

Cloud computing allows fintechs to scale up and down quickly and cost-effectively. In particular, they can move from costly software deployments and only pay for what the services they need when they need them. These cost savings allow fintechs to focus their resources on other, priority areas.

Improved Security

With cloud computing, fintechs can ensure the security of customer data by relying on secure and reliable software-as-a-service (SaaS) providers. Moreover, they shift the security responsibility burden to SaaS providers, something they are more concerned about and have more experience with.

Enhanced Customer Experience

Cloud-based services are more reliable, efficient and convenient as they allow consumers round-the-clock access to their accounts and share information from any device without worrying about data loss or security breaches. Cloud computing also helps fintechs create better experiences by providing better insights into consumer behaviors.

Increased Speed to Market

In the fintech industry, speed to market is key. Cloud-based services allow fintechs to deploy services quickly and easily without worrying about complex on-premises deployments. Cloud-based solutions also offer improved scalability, making it easier for fintechs to scale their operations as needed.

Greater Data Insights

With cloud-based services, fintechs can analyze data more quickly and effectively, allowing them to make better decisions faster than ever before. By using cloud technology, fintechs have access to greater amounts of data than ever, enabling them to understand consumer behavior and preferences better.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest