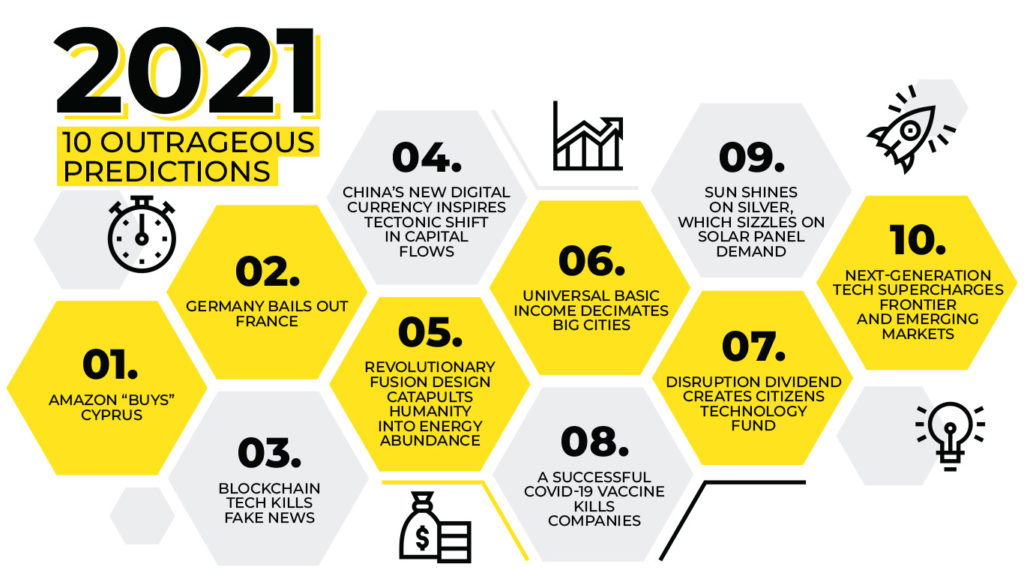

Saxo Bank has released a list of 10 outrageous predictions for 2021. Let’s take a quick peek at these 10 events that are unlikely to happen but would cause shockwaves across financial markets if they did:

- Amazon “buys” Cyprus. Amazon redomiciles its EU headquarters to Cyprus, which welcomes the corporate giant as a way to help reduce its nearly 100% debt-to-GDP ratio. Amazon also “helps” Cyprus rewrite its tax codes to include extremely low levels of corporate and other taxes. This causes the EU, the U.S. and other countries to move against monopolies in 2021.

- Germany bails out France. As France faces increasing public and private debt issues, it fails in its efforts to avoid bankruptcy waves and reassure investor markets. France ends up pleading for Germany to allow the European Central Bank to print enough euros to bail out its banking system and prevent its collapse.

- Blockchain tech kills fake news. As social media giants continue to invest heavily in blockchain tech, it leads them to more easily meet regulatory mandates to identify (and eventually remove) disinformation and fake news.

- China’s new digital currency inspires tectonic shift in capital flows. A blockchain-based digital version of the yuan (CNY) and an opening up of Chinese capital markets to foreigners increases the stability of the Chinese currency as well as makes it a rival to the U.S. dollar (USD) for reserve status. This, in turn, funds an entirely new Chinese pension system and deepens the country’s capital markets.

- Revolutionary fusion design catapults humanity into energy abundance. An advanced AI algorithm solves the super non-linear complexities of plasma physics, clearing the way for commercial fusion energy. The mastery of fusion energy opens up the prospect of a world no longer held back by water or food scarcity thanks to desalination and vertical farming. It’s a world with cheap transportation, fully-unleashed robotics and automation tech, making the current young generation the last required to “work” by necessity.

- Universal basic income decimates big cities. Universal basic income (UBI) and new work-from-home possibilities (stemming from the COVID-19 pandemic) allow people to stay put while making a living. As a result, overpriced real estate in crime-ridden cities becomes less appealing, leading to a mass exodus from cities.

- Disruption dividend creates Citizens Technology Fund. A renewed demand for reducing inequality in 2021 leads to the creation of the Citizens Technology Fund, which transfers a portion of asset ownership of capital assets to everyone (with an extra portion going to displaced workers, allowing them and everyone else to participate in the productivity gains of the digital era). This disruption dividend frees up enormous entrepreneurial energy at the individual and community scale as millions have more time and energy on their hands away from repetitive and stressful jobs.

- A successful Covid-19 vaccine kills companies. An effective COVID-19 vaccine is thought to bring a new boom in economic growth; however, an overstimulated economy causes inflation to rise. This eventually leads corporate defaults to rise to their highest level in years, with the first to go being over-leveraged companies in the physical retail space that were already struggling in the solid, pre-COVID economy.

- Sun shines on silver, which sizzles on solar panel demand. The rapid rise in demand for silver in industrial applications causes its price to soar to an all-time high of USD 50 per ounce in 2021.

- Next-generation tech supercharges frontier and emerging markets. Key technologies accelerate private sector productivity growth in frontier and emerging markets at rates far beyond those seen in developed markets. The three main technologies in this regard are (1) satellite-based internet delivery systems, (2) ongoing revolutions in the FinTech space and (3) drone technology.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest