Tags Digital Transformation Open Banking Regulation

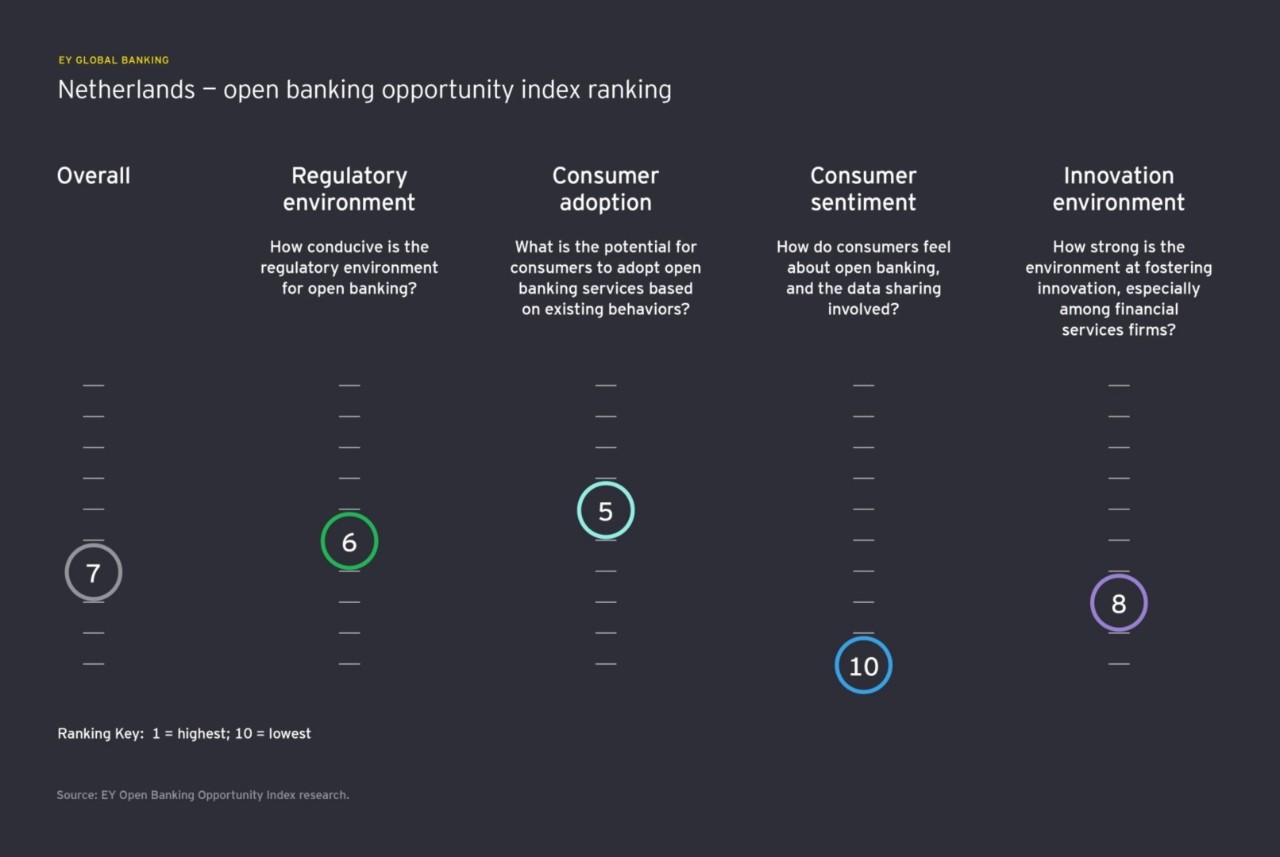

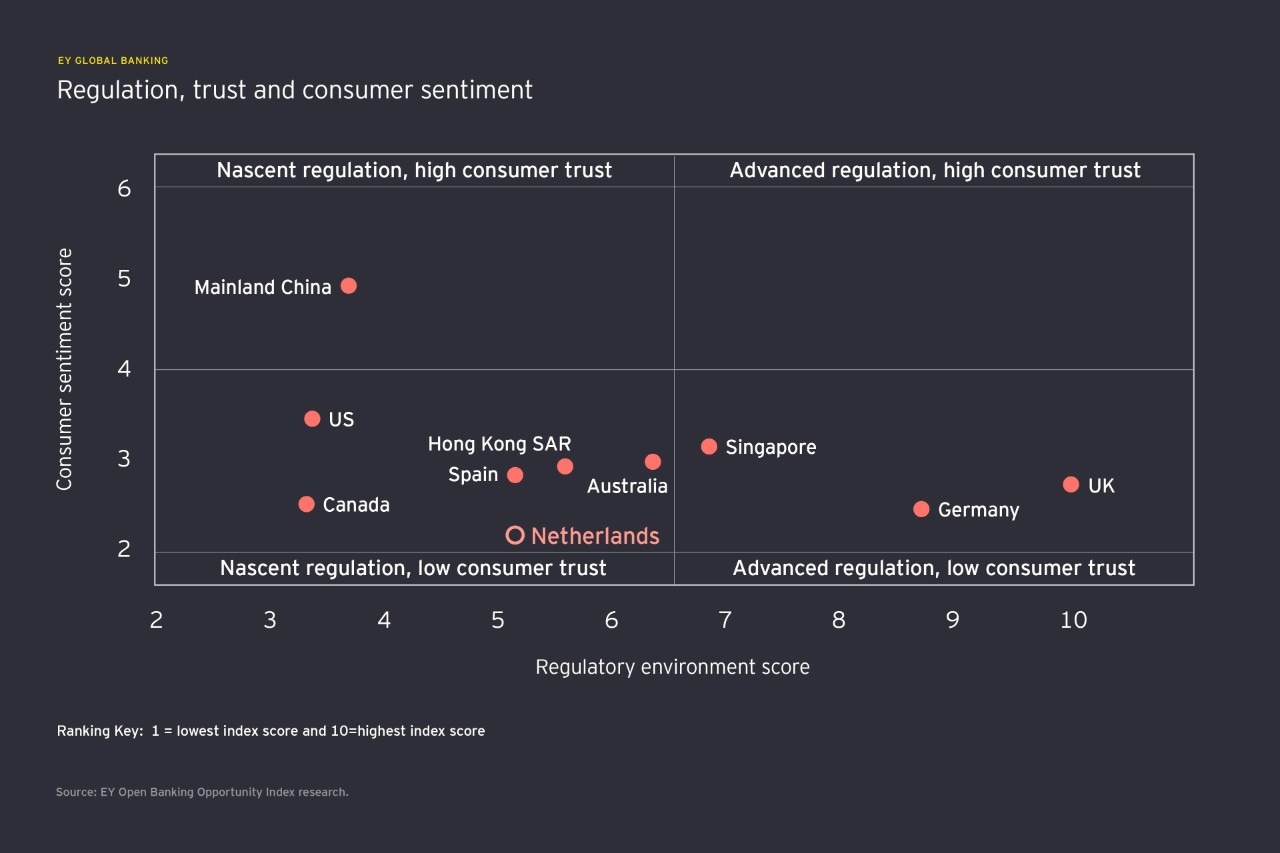

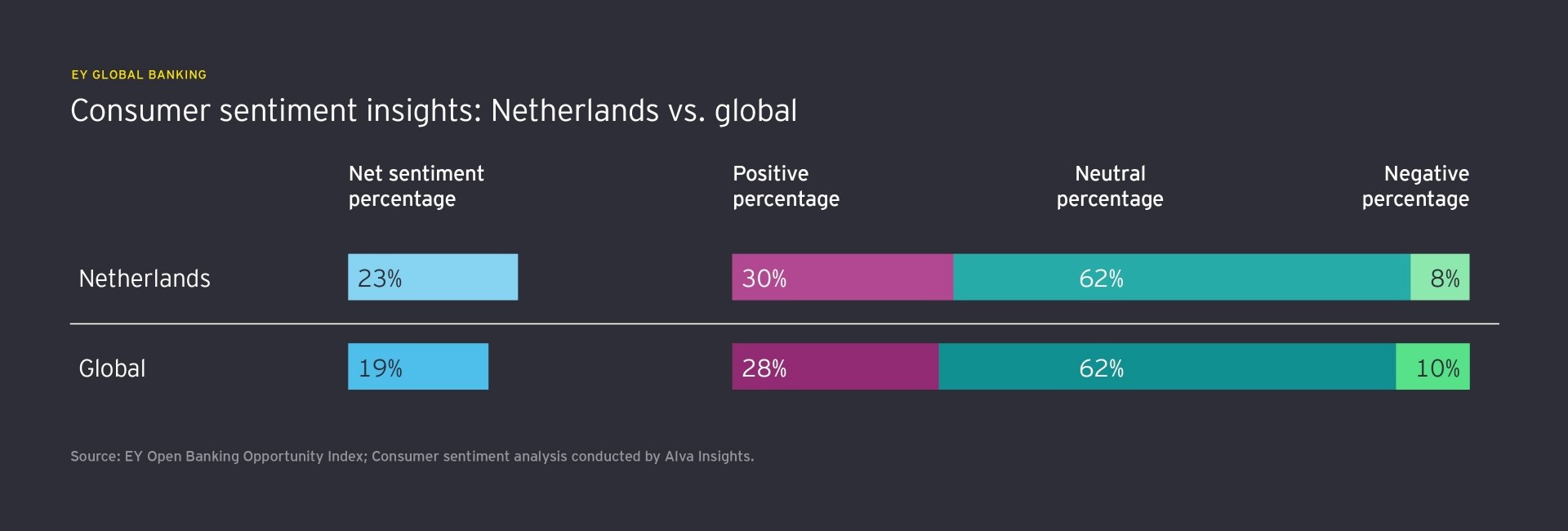

The Second Payment Services Directive (PSD2) underpins open banking across the European Union (EU); however, open banking in the Netherlands has yet to become a reality as Dutch regulators have been slow to transpose the directive into national legislation. Much of this delay centers around ensuring legal protections for data privacy. This concern over data privacy is being driven from Dutch consumers themselves, who have expressed skepticism over whether the benefits of consumer choice and control are worth the risks associated with opening up so much data. That being said, Dutch consumers have proven to be ready adopters of new technology and are willing to share information if the payoff is perceived to be worth it.

As Dutch banks move on from the risk and regulatory projects that have dominated in recent years, innovation will become a bigger priority, including how to best transform for a digital future with open banking. Banks will need to provide innovative products and services that win over consumers or excel in outstanding customer experiences. Others may choose to focus on providing banking operations and technology. However they shape their digital future, Dutch banks will need to embed flexibility into their business model and be prepared to adapt and innovate in response to the evolution of open banking and the new competition it brings.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest