Tags Cryptocurrency Money Transfers Payments

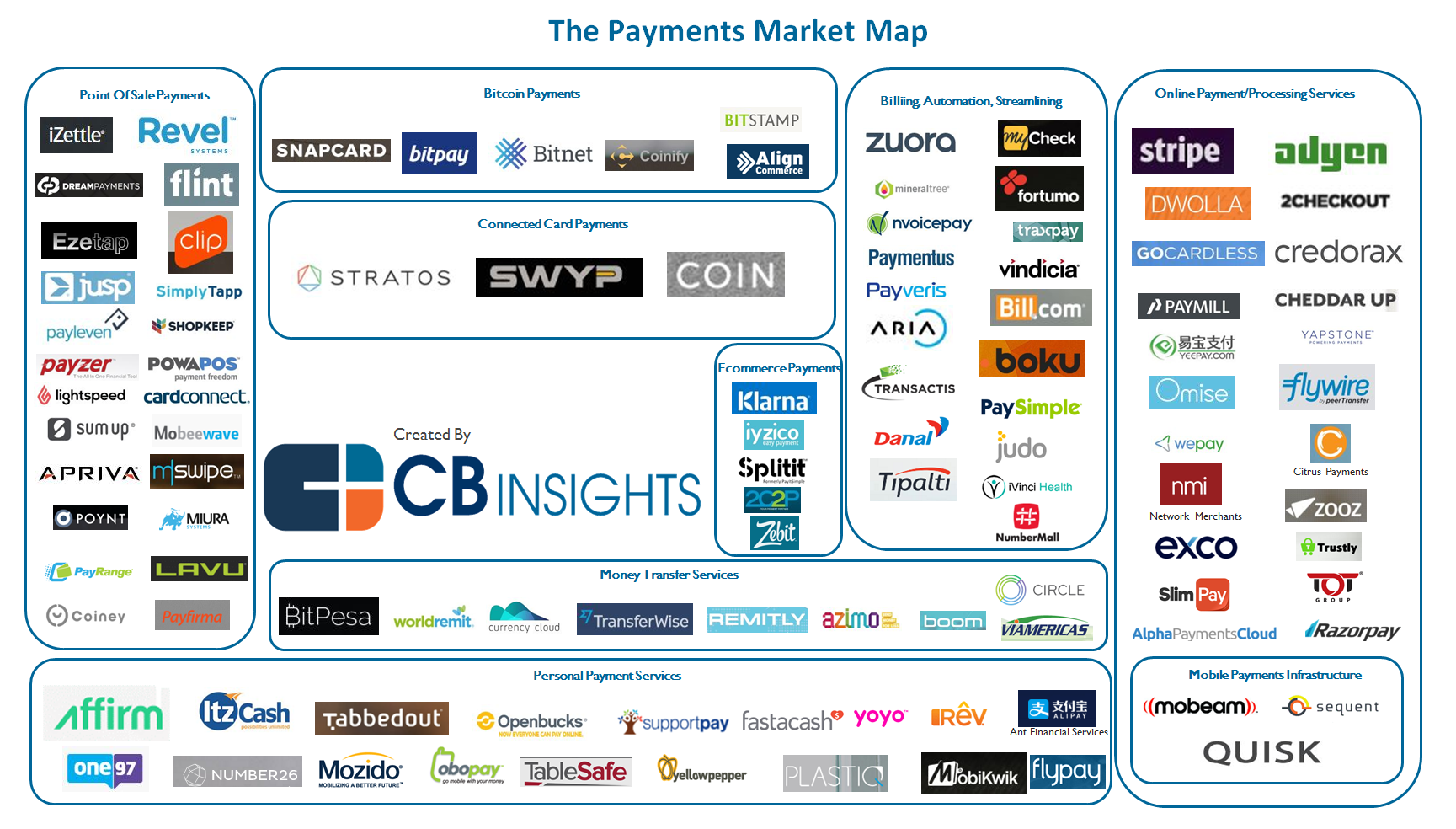

Payment startups have seen considerable momentum in recent years and are on track for USD 3.8 billion in funding this year. From point-of-sale solutions to money transfers and mobile payments, these startups are changing how electronic payments are made, accepted and processed. There are nine main payment categories in which payment startups are getting a lot of attention:

- Online payment services — making payment processing more available, secure and inexpensive

- Billing automation and streamlining — streamlining invoices and automating financial processes and billing

- Point-of-sale payments — offering point-of-sale products and services, including card readers, stands and digital storefronts

- Personal payment services — providing consumers with more convenient payment platforms

- Bitcoin payments — using digital currency to make payments faster and more secure

- E-commerce payments — creating payments solutions geared to the challenges seen by online merchants

- Connected card payments — working on all-in-one connected credit cards as a key link in payment value chains

- Money transfer services — providing digital solutions for sending money across borders quickly and cheaply

- Mobile payment infrastructure — creating and updating the infrastructure necessary to process an increasing volume of mobile payments

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest