The internet of things (IoT) is changing how we interact with the world around us. This video highlights how IoT has allowed analytics to be applied to massive amounts of …

Read More »Video: exploring the future with the internet of things

This video illustrates how the internet of things (IoT) is changing our expectations for what our daily life should like and how our devices should work, including in the financial …

Read More »PrivatBank launches new anti-fraud card technology

PrivatBank has launched a new system that allows users to securely change their PIN codes online, a measure that will help protect customers from card-related fraud. The system will also …

Read More »Infographic: 2017 Consumer Cybersecurity Confidence Index

In an increasingly digital world, consumers want to ensure that their personal information is not at risk of falling into the wrong hands. Here’s a quick overview of consumer opinions …

Read More »FinTech for the financially excluded

The potential of FinTech to help financially excluded populations of the world is well-documented, with FinTech helping to reduce vulnerabilities, build assets, manage cash flows and increase income. Yet FinTech …

Read More »The rise of the robo-advisor in retirement planning

Artificial intelligence (AI) is starting to change the world of retirement planning, with robo-advisors emerging as one of the hottest trends in this field. Robo-advisors are online services that use …

Read More »Building a millennial-friendly brand through social awareness

Millennials represent a drastically different generation than baby boomers or gen-Xers, one that has adapted to a broader range of resources and a much more connected world. Building a millennial-friendly …

Read More »How FinTechs are helping refugees and immigrants

FinTechs have traditionally worked to provide financial services to the unbanked and underbanked. This is especially important today with the increase in the number of refugees and immigrants. Perhaps the …

Read More »How FinTech is helping the unbanked and underbanked

For many around the world (especially those in rural areas), access to financial services represents a major problem; however, FinTech is bridging that gap and helping more and more consumers …

Read More »FinTech is making financing more accessible

Investments in underfunded space, especially for SME lending, are important for increasing financial inclusion. And managing director of Creditease’s FinTech Value Chain Fund, Anju Patwardhan, understands this. For that reason, …

Read More »Video: World FinTech Report 2017 findings

Take a quick tour of the FinTech landscape with this insightful video that outlines the finding of the World FinTech Report 2017. 10 charts that explain IoT’s growth FinTech is …

Read More »Video: how AI is empowering low-income women in India

Find out how voice recognition technology and artificial intelligence (AI) are helping low-income women in India gain access to finance and realize their business dreams. BFC FinTech Monitor (11th — …

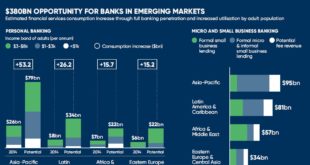

Read More »Infographic: banking the unbanked, a USD 380 billion opportunity

Despite financial inclusion being a key driver for tackling poverty and boosting economic growth, there are billions of people worldwide that do not have reliable access to financial services. This …

Read More »Core principles of success in the sharing economy

The sharing economy has quickly overtaken many business sectors. To be successful in the sharing economy, a company must adhere to four core principles that also define successful entrepreneurship in …

Read More »How should financial institutions react to uberization?

The volume of information in the world is increasing exponentially, and it is becoming difficult for consumers to analyze it all. For this reason, they are turning to mediator platforms …

Read More »Uberization turning the banking business model upside down

Today, customer experience is measured by how much friction is removed, with the new standard being asking Alexa to order an Uber (which arrives in near real-time). For financial institutions …

Read More »Open banking is uberizing Ukraine’s financial services

The era of open banking has come, and it is already starting to change the rules of the game for financial institutions around the world. As this trend continues, it …

Read More »Russia expecting an uberized mortgage market

As Russian financial institutions increasingly offer consumers more and more mobile services, the process of obtaining a mortgage will also become faster and less stressful. In fact some, including Deputy …

Read More »Online marketplace for financial services to open in Russia

We live in a world where startups are emerging everywhere thanks to the idea of aggregated information. For example, to buy a car, you no longer have to go from …

Read More »Innovative solution for investments in Kazakhstan

The National Bank of Kazakhstan has implemented the new ‘Invest Online’ system, an innovative solution designed to operate as a simple, free tool for individuals to invest their money in …

Read More » BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest