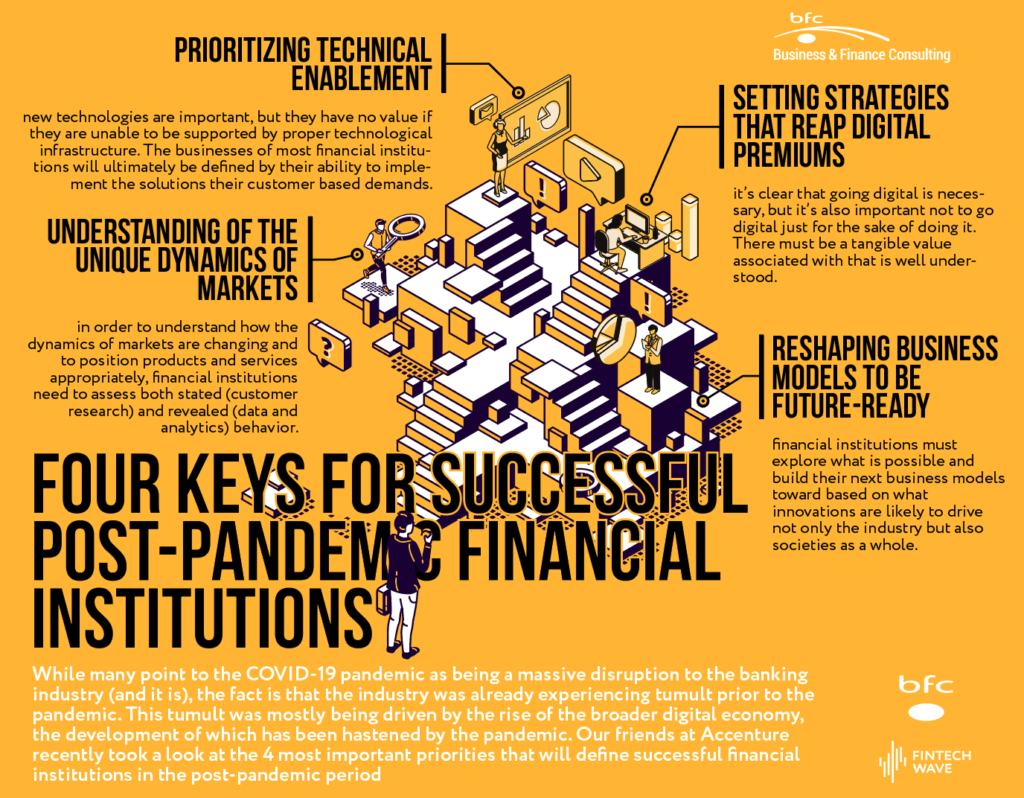

While many point to the COVID-19 pandemic as being a massive disruption to the banking industry (and it is), the fact is that the industry was already experiencing tumult prior to the pandemic. This tumult was mostly being driven by the rise of the broader digital economy, the development of which has been hastened by the pandemic. Our friends at Accenture recently took a look at the 4 most important priorities that will define successful financial institutions in the post-pandemic period:

- Understanding of the unique dynamics of markets – in order to understand how the dynamics of markets are changing and to position products and services appropriately, financial institutions need to assess both stated (customer research) and revealed (data and analytics) behavior.

- Reshaping business models to be future-ready – financial institutions must explore what is possible and build their next business models toward based on what innovations are likely to drive not only the industry but also societies as a whole.

- Setting strategies that reap digital premiums – it’s clear that going digital is necessary, but it’s also important not to go digital just for the sake of doing it. There must be a tangible value associated with that is well understood.

- Prioritizing technical enablement – new technologies are important, but they have no value if they are unable to be supported by proper technological infrastructure. The businesses of most financial institutions will ultimately be defined by their ability to implement the solutions their customer based demands.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest