Tags Digital Banking Online Lending Open Banking SME Startups

Most retail banks are very much behind in digitalization and the rise of FinTech, focusing instead on only allowing the most routine customer transactions online. A recent analysis conducted by Bain and SAP found that only 7% of bank credit products are digital from start to end. While, the big advantage of online lenders is the ease of a loan application process, conducted from a personal laptop or phone at any hour of the day, with no paper-intensive underwriting processes.

This leads to the question of whether or not such banks can and will survive the onslaught of FinTech startups.

Here are a few strategies banks can use to better compete online:

- Make the lending process online for small- and medium-sized enterprises (SMEs) — SMEs represent a pool of underserved clients that have allowed FinTech startups to flourish. Numerous SMEs have indicated a desire for better digital banking tools, especially ones that allow for the loan application process to occur entirely online. Moreover, digitization of the lending process has the potential to substantially reduce the cost of lending at every stage of the process, making SME customers more profitable for lenders.

- Use their competitive advantage — Established banks have real advantages in serving the SME lending market thanks to their benefit of lower cost of finance, brand recognition and an already-established customer base. Comparatively, online lenders have limited brand recognition, and acquiring small business customers online is expensive and competitive.

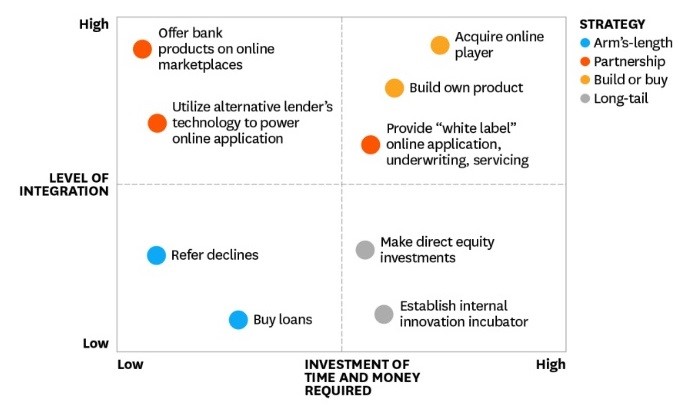

- Choose a strategy (Arm’s-length, Partnership, Build or buy, Long-tail) which is best aligned with their level of digital integration and available resources of time and money.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest