Tags Open Banking Regulation

Countries across the Asia-Pacific region have been quick to establish open banking frameworks following the rollout of open banking regulations in the United Kingdom and the European Union’s passage of the Second Payment Services Directive (PSD2). Here’s a quick overview of the new world of open banking in 6 of them:

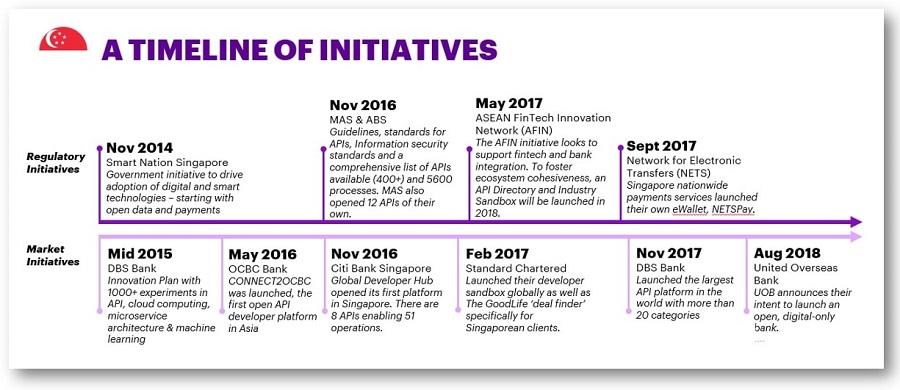

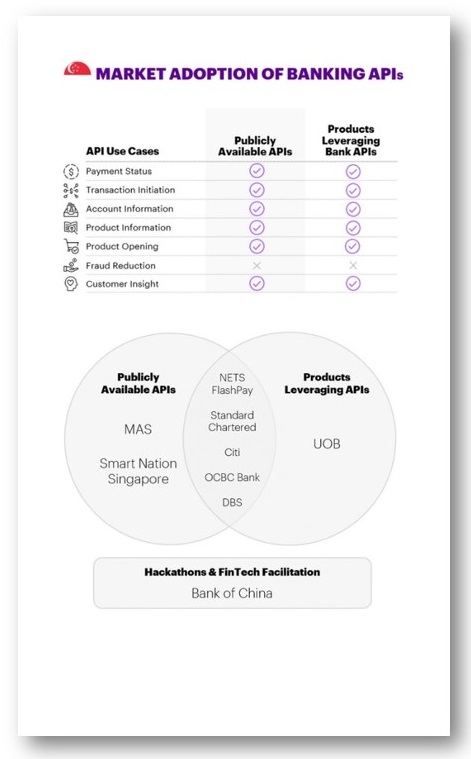

- Singapore – the approach of Singapore’s authorities to open banking has been characterized by a willingness to: (1) shape innovation with a comprehensive, non-mandatory regulation and governance framework, (2) lead by example by opening their own data for APIs and (3) establish scalable data practices and a payments infrastructure that underpin innovation in the area. Singapore has been able to keep a relatively light touch in terms of regulations as banks in Singapore see the opportunities associated with open banking and are already pursuing them.

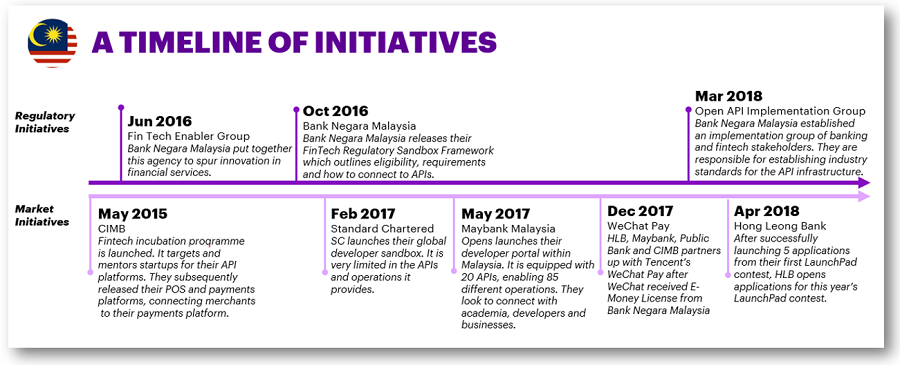

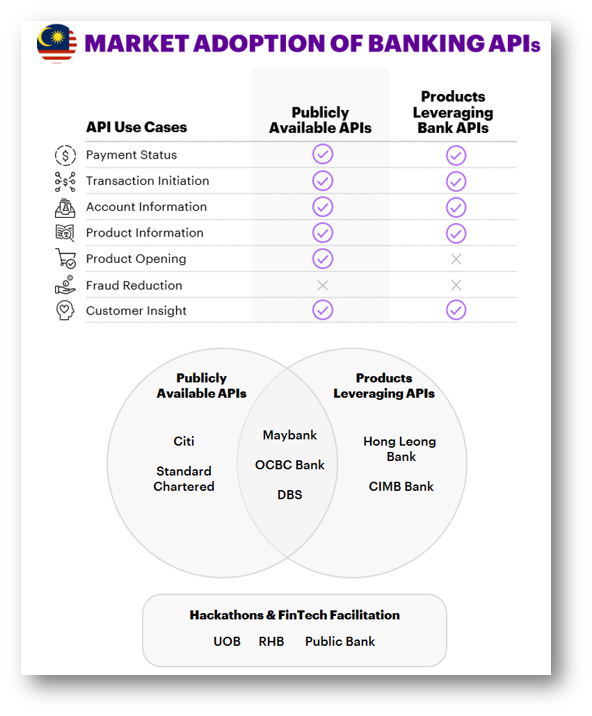

- Malaysia – as with Singapore, Malaysia’s approach has been to establish a non-mandatory framework and to support banking transformation with the creation of implementation teams. Malaysia’s central bank and principal financial services regulator (Bank Negara Malaysia (BNM)) have established a Financial Technology Enabler Group (FTEG) to support innovation in the sector. FTEG is responsible for formulating and enhancing regulatory policies related to the adoption of new technology in financial services in the country. Accordingly, it launched a FinTech Regulatory Sandbox framework to allow the testing of applicable technology, including open banking.

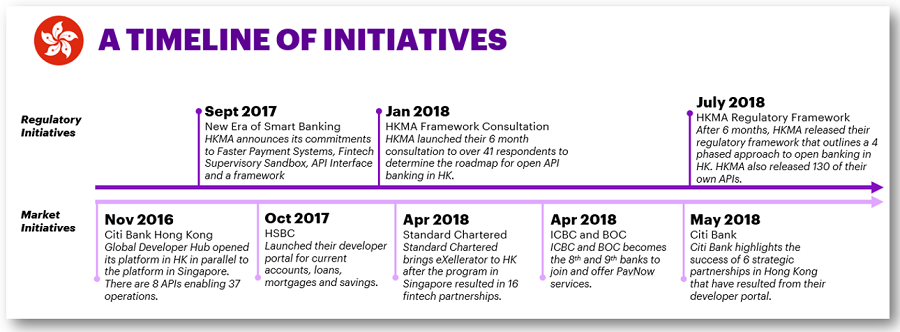

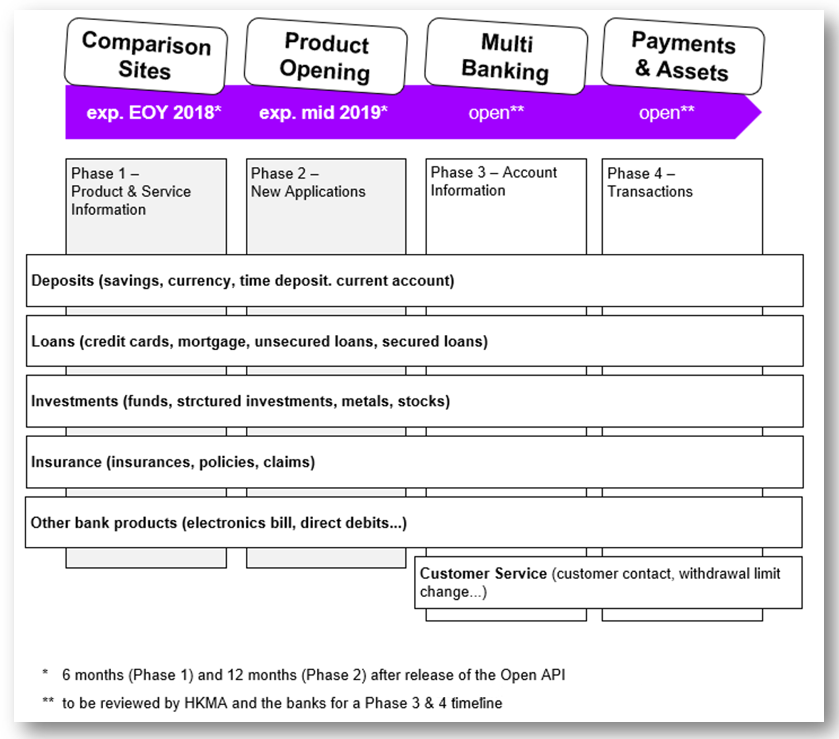

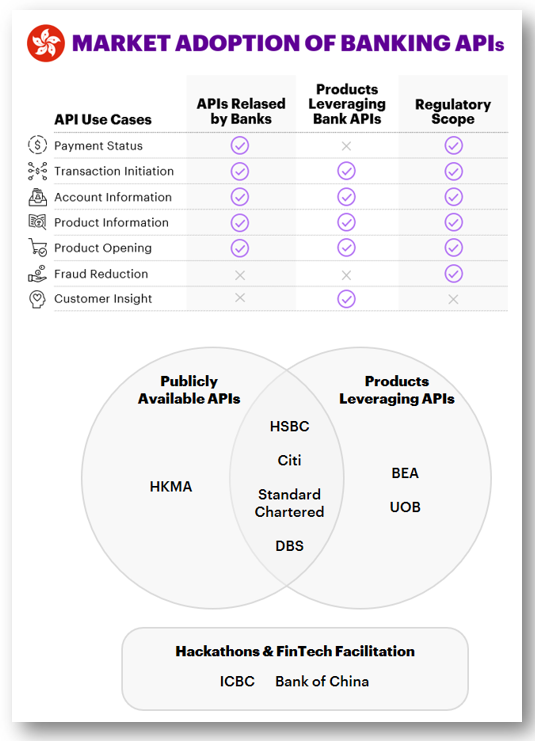

- Hong Kong – following a public consultation, the Hong Kong Monetary Authority (HKMA) published a four-phase approach to implement open banking in the city in July 2018. At the same time, HKMA also published a framework thttps://bankingblog.accenture.com/brave-new-world-open-banking-apac-singaporeo guide financial institutions with recommendations on how to build open application programming interfaces (APIs). It also outlined technical standards and terms for engaging with third-party service providers. This open API framework initiative is part of the HKMA’s long-term Smart Banking strategy that aims to standardize APIs, security parameters and the architectural framework underpinning open banking.

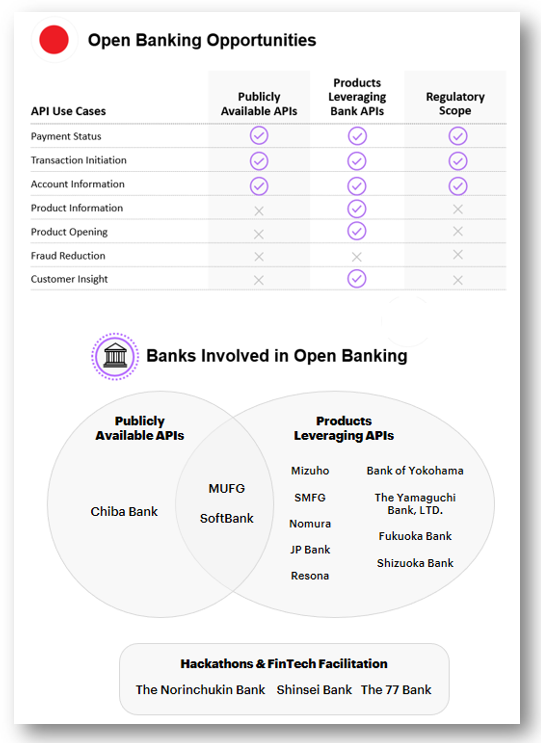

- Japan – In 2015 Japan’s Financial Services Agency (FSA) launched a consultation desk to answer inquiries from fintech companies, which helped pave the way for broader regulatory reforms that set the grounds for the development of open banking in the country. Since then, Japan has established a framework for regulating electronic payment service providers as well as a registry of third-party service providers. In general, regulations used in Japan to cover open APIs uses similar verbiage and definitions outlined in PSD2.

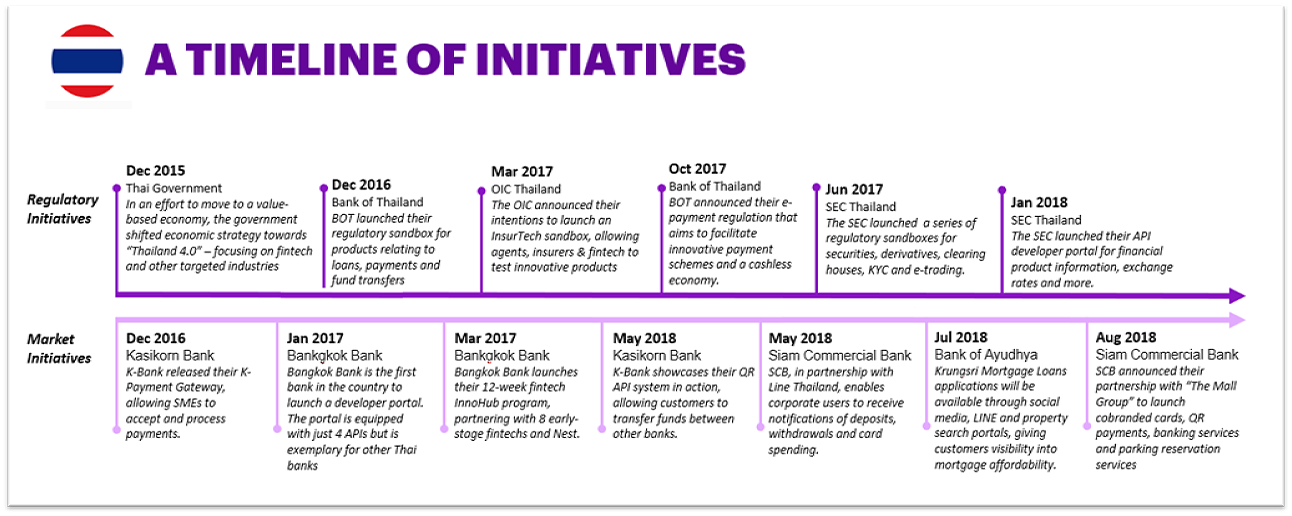

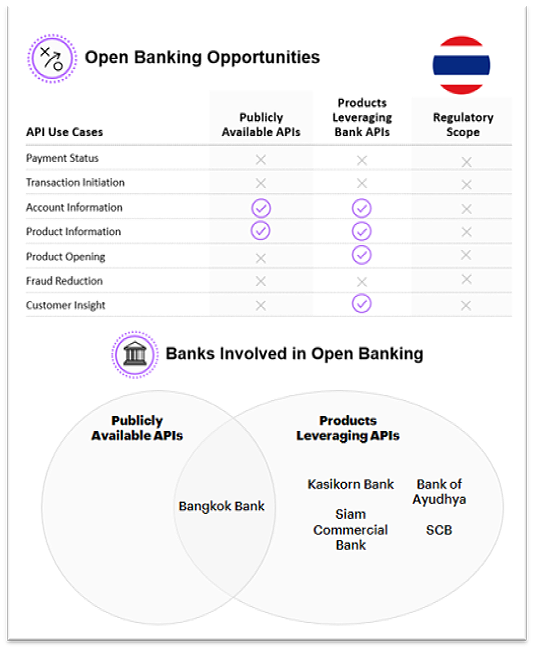

- Thailand – there has been very little regulatory conversation about open banking in Thailand and, to date, regulators have not initiated any frameworks or regulation on the issue. That said, Thailand wishes to become a value-based economy and sees tremendous potential from FinTechs and improved digital services. To this end, the government has launched an initiative to boost FinTech innovation by providing a framework for how e-money and electronic payment services are provided. Regulators have also promoted the use of APIs by releasing their own, and some government institutions (including the Bank of Thailand) have launched sandboxes for FinTech companies to test innovative products.

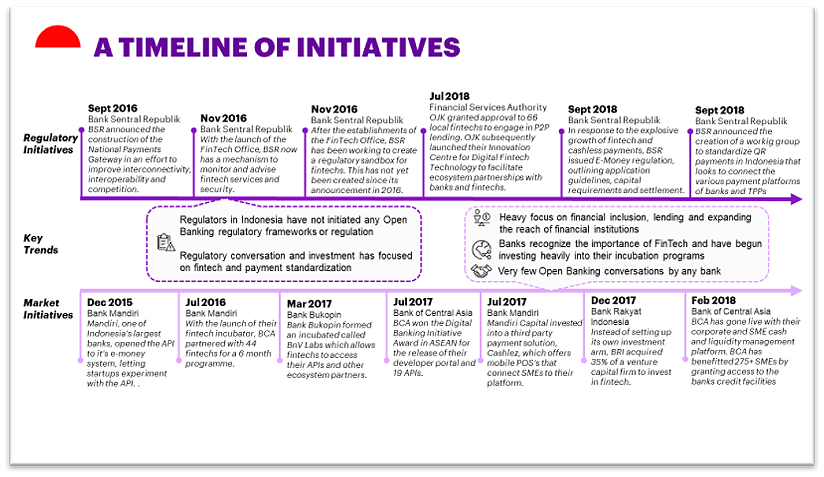

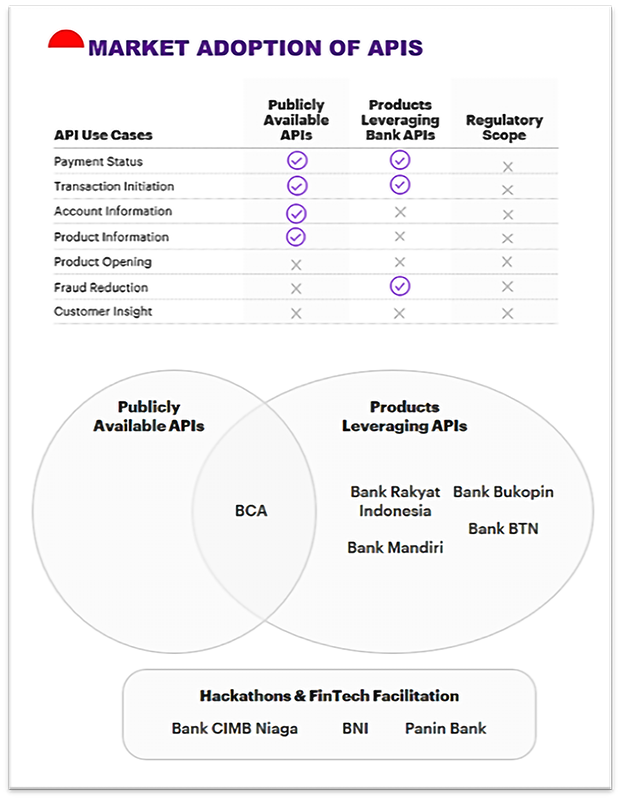

- Indonesia – authorities in Indonesia have not set any open banking frameworks or regulation nor established any timelines for such initiatives, with most official discussions and investment focused on encouraging FinTechs and payment standardization. Regulation instead is driven principally by the goal of improving financial inclusion for the large number of unbanked individuals in Indonesia. Against this background, regulatory bodies have recognized the role FinTechs can play in financial inclusion and have launched numerous working groups to aid banking partnerships and standardization. Indonesia’s central bank is also working on creating a sandbox for help facilitate FinTech innovation in the country.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest