Tags BigTech Digital Banking HR Open Banking

Ever since the financial crisis of 2008, the vast majority of financial institutions have sought to deliver profitability through cost cutting and efficiency measures. While these strategies have worked to varying degrees up until now, future growth will demand much more. Financial institutions need to better understand the transformative forces that are impacting their industry. More importantly, they need to learn how to respond to these trends more proactively. That being said, here are the top 7 trends they need to address or risk becoming obsolete:

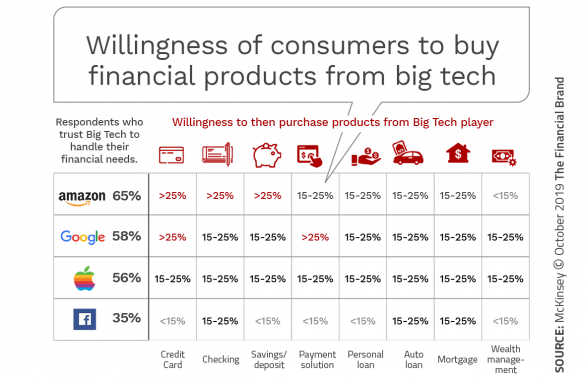

- Big tech firms are a big threat that is becoming bigger as consumer confidence in new disruptors grows.

- Open banking leads to more opportunities. Most financial players believe that non-financial products will grow to represent 10% or more of financial institutions’ profits in the near future.

- The demand for digital banking is growing beyond the younger generations. Digital banking (and more specifically, mobile banking) has become the preferred engagement channel for virtually every consumer segment.

- Social responsibility has become important for all financial institutions. Now more than ever, consumers (especially wealthier consumers) believe banks and credit unions should take an active role in societal issues.

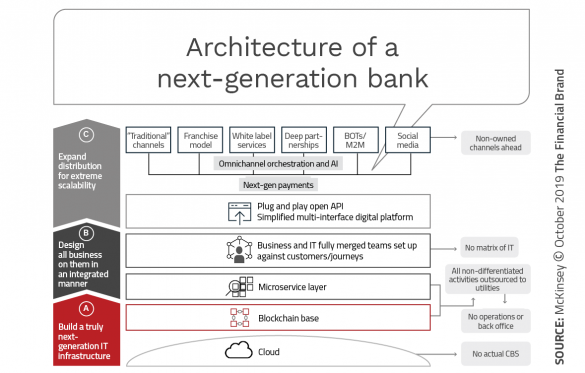

- New back office platforms cut costs and improve experiences Although a seemingly herculean task, the good news is that organizations still lumbering with antiquated legacy systems can benefit from significant technology advances that are easier and less costly to implement than just a couple years ago.

- Improved cyber-security is more important than ever as consumers are taking a more active interest in ensuring their privacy and funds will be protected.

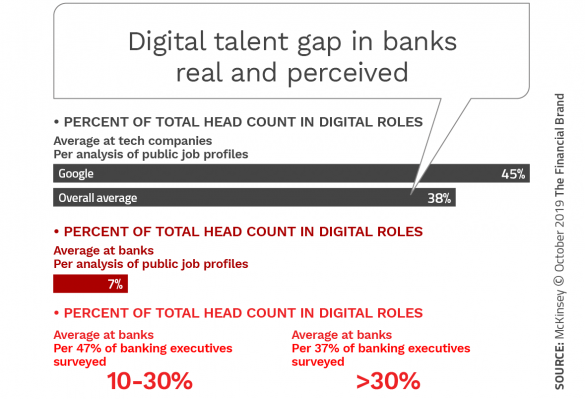

- There will be a critical shortage of talent capable of navigating new, complex technologies. Most financial institutions are not prepared for the digital future. Perhaps even more alarming is that only a few have a plan to retrain or develop current staff for future digital needs.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest