Tags Artificial Intelligence Cryptocurrency Cybersecurity Digital Banking Events Payments Regulation

Stay up-to-date on all the all the latest FinTech news and information from around the world in the BFC FinTech Monitor.

Around the World

- Visa is working out a EUR 1.8 billion deal to acquire Tink, an open banking platform that allows financial institutions, FinTechs and startups to develop financial services.

- Amazon has opened a FinTech lab within the Innovation Center of the Dubai International Financial Center. Amazon hopes to develop solutions (as part of its Amazon Payment Services) for key payment processing pain points small- and medium-sized businesses encounter.

- Revolut is in the process of negotiating a new round of financing. If successful, Revolut’s value could reach USD 20 billion, making it the highest-valued startup in the UK.

- In crypto news: (1) the World Bank has rejected El Salvador’s request for assistance in introducing bitcoin after authorities there decided to distribute USD 117 million worth of the cryptocurrency to citizens; (2) Paraguay has no plans to recognize bitcoin as legal tender; (3) Chinese regulators have ordered banks and payment providers to stop any operations with cryptocurrencies; (4) the UK Financial Conduct Authority found that consumer interest in cryptocurrencies is growing while an understanding of their risks is decreasing; and (5) Iranian authorities have blocked the activities of the local blockchain association IBC, although IBC representatives noted they have received no direct notification of this measure.

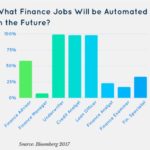

- Ralph Hamers, CEO of UBS Group, believes that artificial intelligence (AI) will not yet replace the role of financial advisors.

- Startup 10x Future Technologies has raised USD 187 million in funding. The company helps traditional financial institutions create new services and work more efficiently.

- According to a new Mastercard report, the UK and Nordic countries are leaders in implementing open banking.

- In central bank digital currency (CBDC) news: (1) analysts believe that CBDCs will not compete with cryptocurrencies; (2) Hyun Sung Shin, head of research at the Bank for International Settlements, sees CBDCs moving past concept phases and into implementation phases; (3) the Industrial and Commercial Bank of China, China’s largest commercial bank, has installed over 3,000 digital yuan ATMs in Beijing; (4) European Central Bank (ECB) board member Fabio Panetta believes the digital euro would be safer than private stablecoins; and (5) Banque de France successfully tested a CBDC in a securities settlement.

- Former PayPal executives are working on a decentralized global payments network that will connect financial institutions, merchants and payment providers for digital currency transactions.

- British FinTech startup Wise is preparing to go public on the London Stock Exchange. This will make Wise the first technology company to choose this way of listing.

Russia

- Experts from Frank RG, Dsight and Visa have named neobanking, niche payment services, services for the self-employed and freelancers, environmentally-responsible banking, big data, biometrics, mobile wallets, virtual cards, personal finance management services and savings products as the main financial and payment trends in Russia for 2021.

- According to data from the analytical marketing company AppsFlyer, Russia is a now a top-5 country in the world in terms of the installation of financial apps.

- Analysts at Visa, Frank RG and DSight have created a list of the top 20 Russian FinTech startups.

- The Central Bank of Russia presented the results of a sociological study on the attitude of the Russian population towards various means of payment. The regulator also released the Regulation of the Risks of Banks’ Participation in Ecosystems and Investments in Immobilized Assets report.

- Mir national payment system cards will be able to connect to the Google Pay contactless payment service, starting from October 26, 2021.

- Visa has launched Visa B2B Connect, a non-card, cross-border payment service for corporate clients in Russia.

- Banking Review columnist Daria Balaboshina discusses the highly-specialized and low-margin POS lending market in Russia, particularly the market’s need to cooperate with large retail chains in order to achieve scale and profitability.

- VTB is developing a new platform for protecting customer data that is based on machine learning. They have also launched a new pay-with-a-glance service and are working to adapt their mobile app solutions to those with disabilities.

- Alfa-Bank has become the first large Russian bank to launch a website using the ‘.bank’ domain. This should help protect clients from fraud attempts.

Ukraine

- Ruslan Kolodyazhny, CTO of the British FinTech company Wirex, describes how Ukrainian banks can integrate digital currencies into their financial services.

- The Ukrainian FinTech Hub will hold the How an MFI Can Become a Neobank discussion panel on July 1, 2021. Register here.

- FinTech company Moneyveo is preparing to issue a Veocard payment card with Visa and IBOX Bank. Card users can expect a 1% cashback reward system as well as a 50% discount for using the credit limit in the first month.

- Taskcombank has launched an electronic document management system for business clients, allowing business clients to sign documents online instead of visiting a branch location.

Belarus

- Paritetbank has launched an electronic trading platform that allows businesses to receive current market quotes and make transactions in foreign currencies.

Kazakhstan

- Kazakhstan ranks 13th in the Asia-Pacific region on the Global FinTech Index.

- Markswebb has published ratings for the most convenient banks for entrepreneurs in Kazakhstan. The publication highlights that, although legislation permits it, financial institutions seem in no hurry to build a completely digital process for opening an account.

- The Open Banking: International Cases and Analysis of the Kazakhstan Market research presentation and panel discussion will take part on July 2, 2021 as a part of Astana Finance Days. Register here.

- BIT Mining Ltd., a leading cryptocurrency mining company, has delivered the first batch of mining equipment to Kazakhstan. The second and third shipments are expected to arrive by July 1, 2021.

Kyrgyzstan

- A new proposal to the On the National Bank of the Kyrgyz Republic, Banks and Banking Activities bill would allow FinTechs to open accounts with the National Bank of the Kyrgyz Republic. It is believed that this would promote the development of FinTechs in the country and eventually allow Kyrgyzstan to become the financial capital of Central Asia. More details on the proposal can be found here and here.

- Behavox has been listed on Forbes’ 50 Best FinTechs in 2021.

Uzbekistan

- Uzbekistan has became the first country to launch the Humans FinTech platform. Vladimir Dobrynin, founder of the platform, discusses why the company decided to start with this particular market and how best to launch ecosystem projects.

- HUMO and Mastercard have issued their first joint card. The card is available in both Asakabank and Anor Bank but will soon appear in other Uzbek banks as well.

Azerbaijan

- The Central Bank of Azerbaijan has called cyberattacks one of the most serious problems of our time.

- Representatives of Mastercard said that non-cash payments in Azerbaijan are growing at double-digit rates.

Armenia

- Evocabank has published digital brochures that can be found using QR codes. It is believed that this will help consumers find the information they are looking for more quickly.

BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest