In a recent interview, Mariusz Zabrocki, managing director of iwoca Poland, spoke about online lending to small- and medium-sized enterprises (SMEs). Mr. Zabrocki noted that SMEs are changing thanks to …

Read More »Sberbank offers online loan process to SMEs

Russia’s Sberbank has become the first in the country to offer loans to small- and medium-sized enterprises (SMEs) completely online. While other banks do offer businesses the chance to begin …

Read More »Proposed amendments to regulate the Kazakhstani online loan market

The National Bank of Kazakhstan has developed a number of amendments that will regulate online lending. Specifically, the amendments will: Require loans be issued only in the national currency Establish …

Read More »Payme application launches online loans in Uzbekistan

Payme users can now receive online loans of up to UZS 1 million. The application now allows users to request a loan within the application. Once the request is sent, …

Read More »Online lending in Kazakhstan expected to grow 200-300% in 2018

Online microlending in Kazakhstan has been steadily growing in the past few years. In 2015, it amounted to KZT 2.5 billion. In 2016, this figure rose to KZT 8.9 billion, …

Read More »Georgia works to balance demand for online loans with proper regulations

The government of Georgia is working to find a proper balance between regulating online loans and allowing online lenders the flexibility they need to meet consumer demands. Economic Minister Dimitri …

Read More »Video: what is online lending?

An online lender is a company that offers loans and other forms of financing through their website. The types of lending provided are usually in the form of lines of …

Read More »Infographic: alternative lending options for small businesses

In today’s financial climate, many banks have stopped lending to new businesses or businesses that do not have sufficient credit. This seemingly leaves many businesses with few options; in reality …

Read More »Video: factoring

Factoring, sometimes referred to as accounts receivable financing, can be a great way for a business to get money fast. However, it can also be a relatively expensive form of …

Read More »Video: the impact of alternative lenders in the next 5 years

This video shares some insights on the impact alternative lenders will have on lending in the next five years. FinTech highlights the good and bad of lending in China Banks …

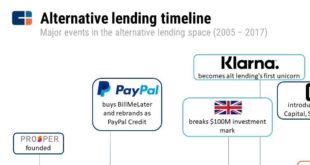

Read More »Infographic: alternative lending timeline

As alternative lending matures into what many are calling “alternative lending 2.0″, it is worth taking a look back at the sector’s evolution since 2005 — from Zopa pioneering peer-to-peer …

Read More »Armenia’s Evocabank launches SingleTouch online loans

Evocabank has launched a new online lending service through its mobile application. SingleTouch loans, available to customers 24 hours a day/7 days a week, are given in local currency at …

Read More »National Bank of Kazakhstan preparing reforms that will affect online microlenders

The National Bank of Kazakhstan is preparing the largest reform in ten years, which will greatly impact online lenders. Currently, the online microloan market in Kazakhstan is almost not regulated …

Read More »Encouraging Georgian SMEs via access to transparent online loans

Georgian Finance Minister Mamuka Bakhtadze has announced changes designed to encourage small- and medium-sized enterprises (SMEs) in the country. As part of this effort, the Finance Minister specifically noted that …

Read More »Banking regulations not suitable for small online lenders using FinTech solutions

In Kazakhstan, the rigid regulations of financial companies now also apply to online lending companies, leaving many to wonder if FinTech companies can thrive (or even survive) under such conditions. …

Read More »The growth of FinTech in Georgia

FinTech is becoming of crucial importance for financial institutions, influencing nearly every financial activity and transforming money management channels. The financial sector in Georgia is no different; here’s a quick …

Read More »WeChat owner receives investment fund license

The Shenzhen representative office of the China Securities Regulatory Commission has issued Tencent a mutual investment fund license, opening the door for the WeChat messenger owner to sell shares directly …

Read More »Lenders should use blockchain for identity verification

A panel discussion of experts on blockchain technology was held during the American Banker’s Digital Lending and Investing conference. During the discussion, the experts concluded that lenders need to start …

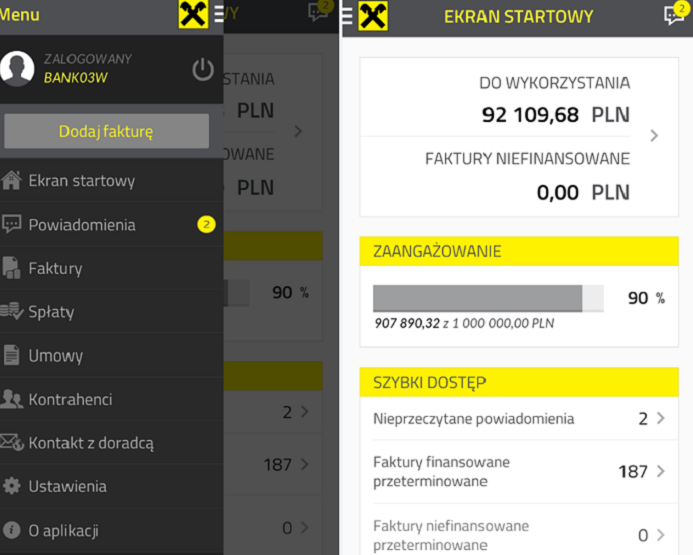

Read More »First-ever factoring app hits Polish market

Raiffeisen Polbank in Poland has launched a mobile banking application for factoring, the first such mobile app on the Polish market. The application allows users to submit invoices for funding, …

Read More »E-mortgage system launched in Azerbaijan

The government of Azerbaijan has completed the integration of an e-mortgage system, the Azerbaijani Mortgage Fund (AMF), into its e-government portal. This means that, as of August 1, 2017, it …

Read More » BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest