The Berlin-based peer-to-peer (P2P) lending platform Bitbond will soon allow its customers to receive loans in bitcoins and other cryptocurrencies around the world. This will help the company bypass the …

Read More »Alternative lending startups changing traditional lending in India

Startup companies are starting to rewrite traditional lending ideas in India. One such company, MoneyTap, uses a chatbot-based loan application system to give customers real-time loan processing and wire loan …

Read More »Online lenders for SMEs

In a recent interview, Mariusz Zabrocki, managing director of iwoca Poland, spoke about online lending to small- and medium-sized enterprises (SMEs). Mr. Zabrocki noted that SMEs are changing thanks to …

Read More »Online lending in Kazakhstan expected to grow 200-300% in 2018

Online microlending in Kazakhstan has been steadily growing in the past few years. In 2015, it amounted to KZT 2.5 billion. In 2016, this figure rose to KZT 8.9 billion, …

Read More »Georgia works to balance demand for online loans with proper regulations

The government of Georgia is working to find a proper balance between regulating online loans and allowing online lenders the flexibility they need to meet consumer demands. Economic Minister Dimitri …

Read More »Video: what is online lending?

An online lender is a company that offers loans and other forms of financing through their website. The types of lending provided are usually in the form of lines of …

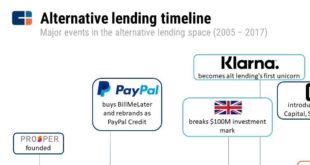

Read More »Infographic: alternative lending timeline

As alternative lending matures into what many are calling “alternative lending 2.0″, it is worth taking a look back at the sector’s evolution since 2005 — from Zopa pioneering peer-to-peer …

Read More »Video: the impact of alternative lenders in the next 5 years

This video shares some insights on the impact alternative lenders will have on lending in the next five years. Video: are some bigtechs unstoppable? Is Big Tech the Future of …

Read More »National Bank of Kazakhstan preparing reforms that will affect online microlenders

The National Bank of Kazakhstan is preparing the largest reform in ten years, which will greatly impact online lenders. Currently, the online microloan market in Kazakhstan is almost not regulated …

Read More »Encouraging Georgian SMEs via access to transparent online loans

Georgian Finance Minister Mamuka Bakhtadze has announced changes designed to encourage small- and medium-sized enterprises (SMEs) in the country. As part of this effort, the Finance Minister specifically noted that …

Read More »Top 10 trends impacting the future of payments

The way people make payments is changing faster than any area of financial services, and understanding trends in payments is important for any financial institution wanting to serve the complete …

Read More »Kazakh FinTech business opportunities being driven to other countries

As FinTech continues to become an important aspect of how financial markets all over the world operate, pressure from Kazakh regulators and information attacks directed against the online lending sector …

Read More »RegTech startups to be included in Accenture’s latest Innovation Lab

RegTech startups that offer solutions for financial regulatory requirements are being invited to join Accenture’s sixth FinTech Innovation Lab for the first time. Accenture made the decision to increase in …

Read More »The growth of FinTech in Georgia

FinTech is becoming of crucial importance for financial institutions, influencing nearly every financial activity and transforming money management channels. The financial sector in Georgia is no different; here’s a quick …

Read More »Banking regulations not suitable for small online lenders using FinTech solutions

In Kazakhstan, the rigid regulations of financial companies now also apply to online lending companies, leaving many to wonder if FinTech companies can thrive (or even survive) under such conditions. …

Read More »EU regulators seek to shape the future of FinTech

A new action plan from the European Commission (EC) is aiming to support the growth of technology-enabled financial services. The action plan, due to be launched in spring 2018, will …

Read More »UK to harness FinTech to ensure an economy for the future

The government of the United Kingdom (UK) has unveiled its first FinTech sector strategy. A cryptoassets task force (consisting of Her Majesty’s Treasury, the Bank of England (BoE) and the Financial …

Read More »RegTech and its driving forces

RegTech has become one of the latest buzzwords in the FinTech world. But what exactly is RegTech? And what’s driving it? RegTech, in its broadest sense, is any technology and/or …

Read More »Penta: a new digital bank for startups and SMEs

German company Penta is partnering with solarisBank to launch a new digital bank that has been designed to meet all the needs of startups and small- and medium-sized enterprises (SMEs). …

Read More »Survey finds fintech firms moving from bank foe to bank friend

For the tenth consecutive year, Temenos has conducted a comprehensive banking survey, covering areas such as the industry’s corporate and IT priorities, business challenges, competitive trends and progress to becoming …

Read More » BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest