With billions being spent to detect, report and investigate banking transactions that might be connected to illegal activities, many are examining how machine learning and artificial intelligence could reduce costs …

Read More »Finding the brains behind artificial intelligence

As financial institutions seek to introduce artificial intelligence solutions, they need to find qualified specialists capable of completing this work. Large financial institutions are creating teams of strong mathematicians and …

Read More »The human cost of artificial intelligence

As artificial intelligence becomes one of the most popular buzzwords circulating in tech and business circles, one thing is frequently overlooked — the human cost. Although artificial intelligence is expected …

Read More »New technologies will reduce bank workforce by 30%

Vikram Pandit, former head of Citigroup financial corporation, believes that, in the next five years, automation, artificial intelligence and machine learning are expected to significantly reduce the need for human …

Read More »Artificial intelligence to help in fight against money laundering

HSBC Bank, one of the largest in the world, has engaged an American artificial intelligence startup, Ayasdi, to develop technology to automate banking investigations into money laundering. Once developed, the …

Read More »Mastercard takes blockchain mainstream with API

Mastercard has tested and validated its own blockchain and will be opening access to it via a set of three APIs published on the Mastercard Developers website. The APIs include …

Read More »IMF head: cryptocurrencies not a threat to central banks

The head of the International Monetary Fund (IMF), Christine Lagarde, believes that bitcoin and other cryptocurrencies do not pose a threat to central banks and traditional currencies. Moreover, she has …

Read More »Digital banking services in the post-Soviet space evaluated

Markswebb has prepared the Mobile Banking Rank CIS 2017. The study evaluated 86 mobile applications of 41 banks on both iPhone and Android devices, evaluating how easily users can manage …

Read More »Top 10 retail banking innovations in the world

The Efma–Accenture Banking Innovation award program is an initiative program aimed at identifying and awarding the most innovative projects in retail banking at a global level. The program, now in …

Read More »Banks need to develop their own mobile wallets

Mobile wallet use is growing. Most consumers (65%), however, want one payment application on their phone, and most would prefer that that application be from their bank. This presents a …

Read More »Europeans comfortable with digital banking, payments

The annual Visa Digital Payments Study has found that 77% of Europeans now use their mobile devices to keep track of their finances and make everyday payments. 62% use a …

Read More »Mobile banking trends in Eastern Europe and Central Asia

The website Future banking recently conducted a review of the development of mobile banking in Azerbaijan, Belarus, Georgia, Kazakhstan and Ukraine. The trends in these countries revolve around mobile electronic …

Read More »Self-boarding of corporate clients becoming more popular

Many banks are now moving to self-boarding for corporate clients in regards to their online account accesses and privileges. Self-boarding allows corporations to set up their own users for their …

Read More »Customer-driven card-control systems gaining in popularity

Customer-driven card-control systems are starting to become more popular. They also provide greater security and a way for customers to control their payment instruments via one smartphone-ported application. Specifically, card-control …

Read More »Alfa-Bank going mobile only

Alfa-Bank has stopped development on its internet banking to focus solely on the development of mobile banking as more and more users increasingly use that service. The bank’s concept of …

Read More »Traditional banks increasingly embracing Fintech

Once seen as a disrupter, Fintech is now being embraced by many traditional banks as the fast-track to digital and cultural transformation that is necessary to attract and keep customers …

Read More »Should – be – known facts about the ATM

The automated teller machine (ATM) turned 50 years old this June. In celebration of its 50th anniversary, here are little-known facts about the ATM: The first “cash-dispenser” was installed in …

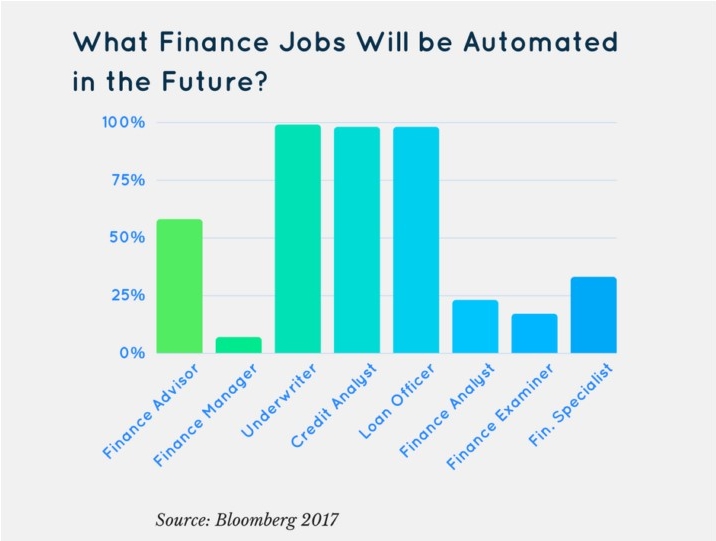

Read More »Will your job become automated?

What if, in the not-too-distant future, there won’t be enough jobs for people? Some economists believe that, as robots and artificial intelligence become increasingly capable of performing tasks, there will …

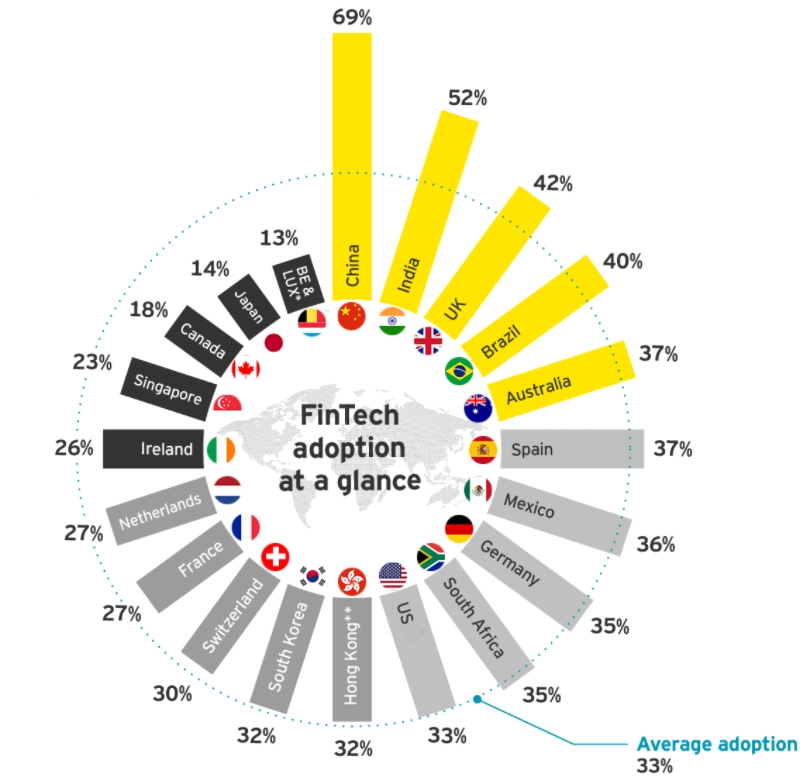

Read More »EY report: Fintech penetration rates around the world

The most recent Ernst & Young survey of more than 22,000 digitally active consumers highlights the impressive and rapid growth of the adoption of fintech and its variations within 20 …

Read More »A blockchain explanation even your parents could understand

When first encountered, blockchain can seem like a complex concept to understand; however, simple words and common associations can help overcome that complexity and make blockchain into something that can …

Read More » BFC Bulletins Monthly News Digest

BFC Bulletins Monthly News Digest